Finance Options for Solar Projects – Commercial Funding and Solar Business Grants

Investing in commercial solar projects doesn’t have to strain your budget. We can help you navigate the commercial solar funding options including capex, power purchase agreements, asset finance as well as business solar grants.

Reduce your energy bills

Increase your energy security

Enhance your sustainability

Get a free business solar quote

Finance options for solar projects

One of the biggest obstacles for businesses to start a solar project is the upfront cost. But this obstacle is effectively a thing of the past. With an overall reduction in the cost of installing solar and the emergence of several funding options, getting solar for your business is now easier than ever.

There are three broad methods of funding a solar project

Commercial solar business grants are sometimes made available, but these are often dependent on current Government Policy as well as local government initiatives and can be limited to specific geographical areas or industry sectors.

Solar funding: Capital Expenditure (Capex)

Capex is very simple to understand. If you have the funds available to spend on solar up front, you will get the best payback from the system. By spending capital on the solar project your initial outlay is relatively high, but you will own the system outright, from day one and will receive the highest return on your investment.

Because you own the system, you will receive the maximum cost benefits from reduced electricity costs. Businesses who spend on solar using capex will typically see a return in under seven years, and we often see customers achieve a full return within four or five years.

Advantages of Capex

- You start to see the full cost-saving benefit as soon as the system is turned on.

- Full green credentials – all CO2 reductions can be attributed against your Scope 2 emissions

- No interest or finance payments are required

- You own the system, meaning if you own the building, the property value increases, and it is more attractive to potential tenants or buyers.

Who is eligible?

- Any company with funds available. Typically a 100kWp system would cost around £70,000. This is roughly equivalent to the ConSpare project we undertook.

- A 500kWp system would cost closer to £300,000. Our Swift Precision Tools project is a useful benchmark as a 600kWp system.

Power Purchase Agreements (PPA) for Solar

A solar PPA is a great vehicle for funding a solar project. A solar power purchase agreement means a third party (often a PPA fund) will finance the solar panels going onto the customer’s roof, installed by a professional commercial solar installer like Geo Green Power.

The customer is then sub-metered for the electricity, which is charged at a reduced rate than their existing electricity tariff from the grid.

The customer is able to attribute all of the green credentials of having solar (Scope 2 emissions for example) to their business operations without paying any upfront cost. They also obtain electricity at a lower rate than they were paying before.

Advantages of PPA

- Benefit from sustainable energy without the upfront cost

- Save on energy bills and lessen your exposure to energy market price fluctuations

- Reduce your carbon footprint and benefit from the competitive advantage of your business demonstrating a commitment to sustainability

- No upfront costs to accessing renewable energy for your business

Who is eligible?

- Size of a company and energy consumption – establishments with higher energy needs will have increased access to PPA options

- Your location and premises – your geographical location needs to be suitable for a renewable energy project

- Grid connection agreement – as with all solar installations, your solar PV system will require DNO approval

- Your energy usage patterns – fluctuating energy usage may mean that your business is not a good fit for a PPA

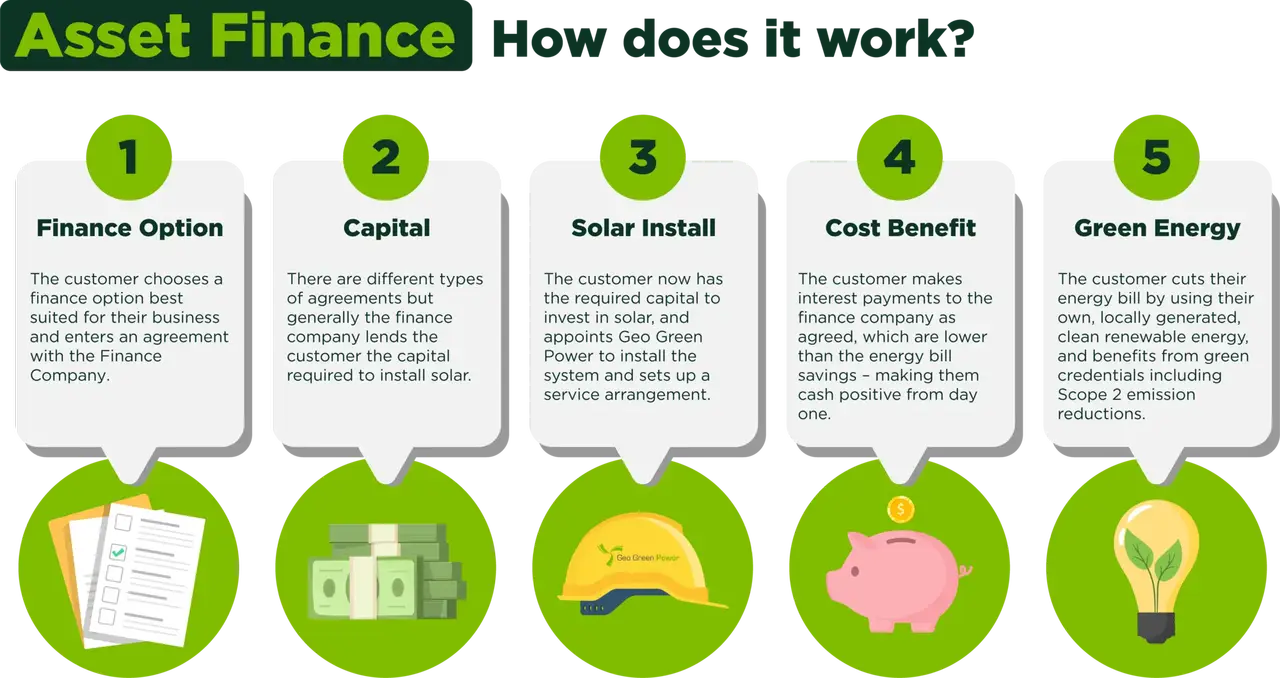

Asset Finance for Solar

Asset finance is a specific type of loan funded through a financial institution like Anglo Scottish. They will lend the customer the funds to pay for a solar project, whilst charging the customer a small premium via interest.

It is normal to pay a small deposit (20%) upfront, but like a PPA, customers receive all the sustainability credentials solar offers. If the interest payments on the loan are lower than the customer’s previous electricity rate, they will be cash-positive from day one.

Several of our customers have achieved their solar projects through asset finance.

Advantages of Asset Finance

- Small or no upfront costs when purchasing high-value items

- Allows you to spread the cost of your solar PV system over several payments

- Fixed payments make budgeting easier

Who is eligible?

- You may have to demonstrate that you have a minimum turnover threshold in the region of £100,000 per annum

- Your business must be capable of meeting all ongoing financial commitments. Your credit history and stability will need to be assessed

Recent Installations

Get a commercial solar quote

If you’re interested in understanding what renewable energy can offer your operation contact our team today!

Business Solar Grants

Business solar grants are available sporadically. Many government grants and subsidies for solar and renewable energy are now closed but there are some new schemes coming online. The availability of grants depends on the Government’s current policy, but local government often put funds together to encourage local businesses to maintain green initiatives, often in particular areas.

Current business grants available for solar

One of the most prevalent grant schemes, launched in March 2025 was Great British Energy’s funding for Schools and Hospitals. This is a fund of £200m ring-fenced for 200 schools and 200 hospitals to take advantage of solar PV to boost efficiency in the public sector.

Regional solar schemes

Some of the current regional schemes include:

- Suffolk’s ‘Net Zero Innovation Fund.

- The Staffordshire CC Green Solutions Programme.

- ‘The Accelerator Project’ running in the East Midlands.

Ofgem also has some resources available to help businesses find out more about solar grants and funding.

You can also ask your local council for information of sustainability and energy efficiency grants.

Geo Green Power went above and beyond to support the implementation of this project and their vast knowledge, support, and attention to detail was second to none.

The systems are working well and we’re already seeing a higher than expected return even in the less favourable periods of the year.

The team at Geo Green Power were brilliant. The site-workers completed the job carefully, efficiently and quickly. The installation has been working really well and we’re very pleased with it so far.

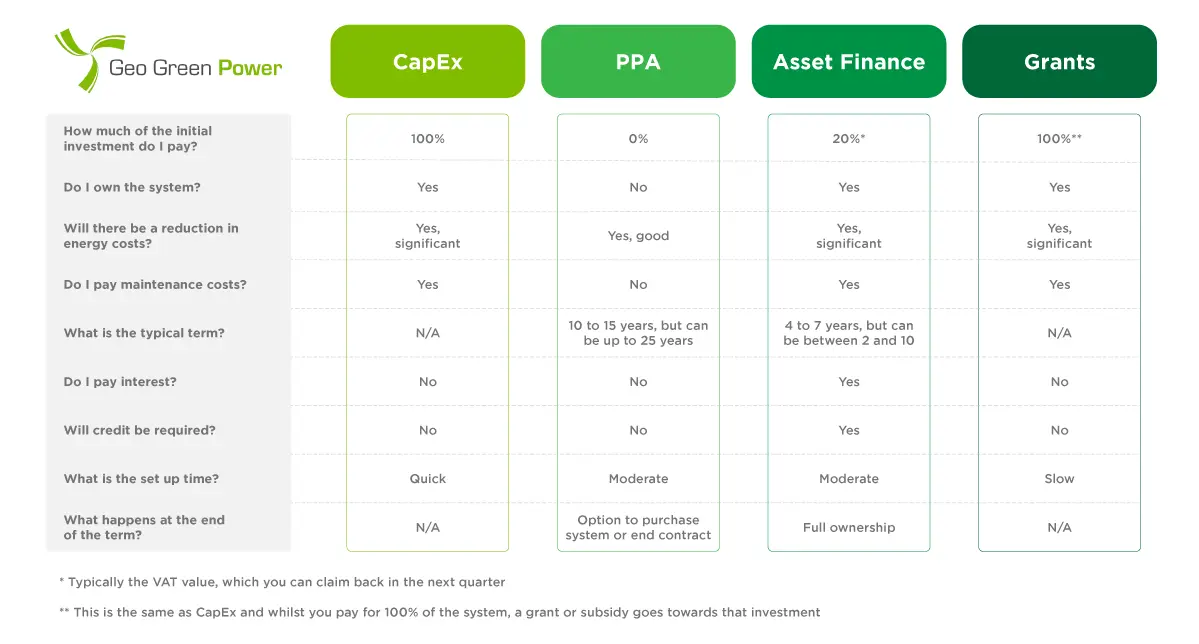

Comparison of Solar Funding Options

Choosing a finance option will very much depend on your business circumstances and requirements. Not every option is right for every business. Geo Green Power can support you with finding out more about which funding model is best for your business.

You can contact us today to discuss the options. Once we attend your site and provide a free survey, we will be able to discuss all the viable options with you. We will provide honest, experienced insights into which funding model may best suit your individual needs

To understand more about what finance option is right for you, you can look at our quick solar funding comparison guide.

![Conspare 2]](https://www.geogreenpower.com/wp-content/uploads/2024/06/Conspare-2-400x250.webp)